Dec 12

preview

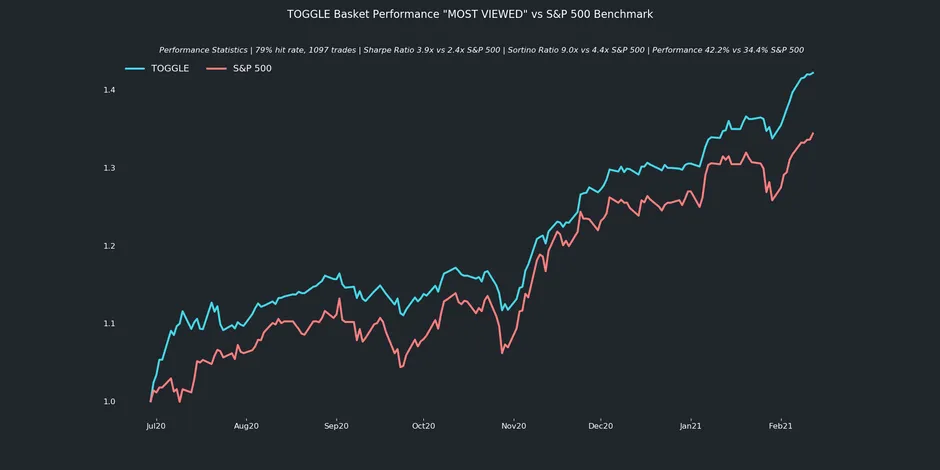

The results are in, and they look good. Analyzing the performance of the most popular TOGGLE insights of the last 6 months against the S&P 500, we found that they outperformed the market by a whopping margin. When the wisdom of the crowd meets the wisdom of AI, individual investors can beat the market. We call it the Crowd & Cloud effect.

Common wisdom and a large body of academic research both suggest that individuals are unable to systematically outperform the market. In fact, they typically underperform by about 10%. This argument underpinned the dramatic growth of the low-cost passive investing industry from the mid-2000s onward.

But what if individual investors could outperform the market, with the help of better tools? It turns out they can.

What explains the inability of individual investors to match or exceed market returns? Beyond the blanket (and bland) “Markets are efficient” retort, research papers document that individual investors typically:

If these behaviors are deeply ingrained and lead to market underperformance, is a low-cost index fund the best solution?

Not necessarily. The biases documented above are not inevitable but they do require a more rigorous approach to investing. Individuals CAN outperform: but they need better tools. Enter TOGGLE Copilot.

Much like computers in airplanes help pilots if they get disoriented by fog or clouds, TOGGLE is able to guide individual investors. Traders can grasp all the key info about a stock in a matter of seconds, as the AI paints a comprehensive and concise picture of the stock in real-time.

Accessing the right info can stop an investor from two key errors:

TOGGLE isn’t recommending what to buy or sell - rather it shows traders whether the stars are aligned.

We studied all TOGGLE insights that were followed by Togglers. The most popular insights substantially outperformed the market: human-machine collaboration at its best. Since Copilot launched last year, those TOGGLE insights outperformed the S&P 500 by a whopping 8% in aggregate, an 18% differential from the expected performance.

This isn't all machine’s doing: it’s the collaboration between investors and the machine. Investors need to pick stocks among hundreds that are available. They have to manage each trade, timing entry and exit. TOGGLE simply makes the journey smoother, helping you avoid pockets of turbulence or find clear air above the clouds.

Individuals CAN outperform: but they need better tools.

References

Up Next

Dec 12

preview