4 Option Greeks

The price of an option changes when the price of its underlying asset changes - as it’s intuitive.

However, this relationship is affected by other factors such as time and how pricey options are today in general.

The Greeks are parameters that tell us how sensitive an option is to these factors: to time-value decay, to changes in implied volatility and to movements in the price of the underlying asset.

These factors encompass the various risk measures and price movements, which drive the value of an option.

The 4 Greeks are an option’s delta, gamma, theta, and vega. .

Delta (Δ) - measures the change in an option’s value when a change in the underlying asset occurs

Delta is the simplest of the Greeks to understand. If delta is for example 50%, it means that if the price of the underlying asset changes by $1, then the price of the option changes by $0.5.

For puts, the delta ranges from -100 to 0 and for calls, the delta ranges from 0 to 100. Delta for puts are negative because they have an inverse relationship with the underlying - the value of the put falls when the underlying rises and vice versa. On the other hand, if the underlying price rises, the value of the call option increases, as long as there is no change in the other greeks. Options that are likely to expire in-the-money will have a higher delta and tend to be more expensive since they’re more likely to expire profitable.

Gamma (Γ) - measures the rate of delta’s change over time

Suppose 2 similar options have different gamma values: one higher and one lower. The option with the higher gamma might see the largest change in delta if the underlying changes - so you thought you had a 50-delta option, but prices rally and all of a sudden your delta is 70!. Gamma is higher close to a strike, lower away from it. If delta represents the probability of an option expiring in the money, gamma represents the stability of that probability.

Theta (θ) - measures the price decay of an option as time passes

As time progresses, the chance of an option expiring in-the-money (profitable) decreases and as the expiration date gets closer, theta starts to accelerate as there is less time to earn a profit from trading the option. The value of the option starts linearly diminishing as soon as it’s been purchased and starts to exponentially diminish as the expiration date nears.

Vega (ν) - measures the risk of changes in implied volatility, affecting the price forecast of an asset

Investors use an asset’s implied volatility as a measure to forecast future movements in the price of a security and its option value: when volatility is expected to increase means the implied volatility is rising, which will cause the value of the option to likely increase as well since there’s a great chance of hitting the strike price. Vega decreases as the option nears expiration as the likelihood of hitting the strike price decreases.

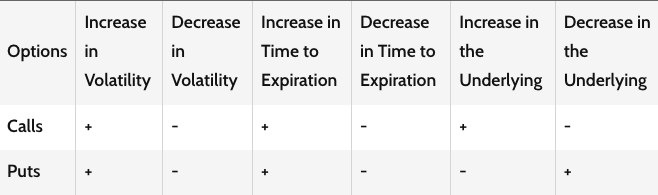

We know that a call option holder will profit when the underlying asset price is higher than their option strike price (and vice versa for put option holders). Therefore, the following table shows you the influence each factor has on the price of a call or put option and hence, your potential profit. Remember that results would differ based on if a trader was long or short.

*kudos to Investopedia for this great table